How to do a Free CIBIL score check with your PAN card

- OfferZoneDeals Team

- Oct 2, 2022

- 3 min read

Updated: Jun 19, 2023

With one of the largest databases of consumer data, CIBIL is the leading credit information provider in India. A credit score, also known as a CIBIL Score, is a 3-digit number that represents how well you have managed credit in the past, such as a home loan, personal loan, or credit cards. It is primarily a measure of your borrowing capacity, calculated based on your credit history.

Simply put, your credit score tells lenders whether you are a reliable or risky borrower, as well as your likelihood of repaying a new loan responsibly. When you apply for a loan or a credit card, the lender bank or NBFC closely examines your credit score and credit history, which are kept on file in your credit report.

Out of 900 points, your credit score is determined. Lenders are more likely to provide you new credit if your score is higher. Typically, lenders prefer borrowers with credit scores of 750 or above for any type of loan or credit card.

Your credit score is likely to suffer if you frequently fail to make your credit card or loan EMI payments on time. However, if you have been responsible with your credit card and EMI payments and haven't shown any signs of being credit-hungry by applying for credit frequently, your credit score is likely to be high.

Affiliate

Your credit score is maintained and calculated by a credit bureau called CIBIL, or Credit Information Bureau (India) Limited. Experian, CRIF High Mark, and Equifax are the other credit bureaus in India that offer you your credit report; CIBIL is the oldest. Each credit bureau independently determines your score based on the credit data that is routinely submitted to them by banks and NBFCs. Your credit score will likely vary amongst credit bureaus because each uses a different model to determine it.

With Cibil website you can:

Visit the CIBIL Dashboard.

View the Score and Report for your CIBIL. It can be updated once a year.

Recognize frauds and mistakes

Verify your credit information for any fraud or mistakes.

Offers for Personalized Loans

loan options that are customised depending on your CIBIL Score.

Everyone should check their credit score frequently for the sake of financial stability. It is a significant part of your financial history and provides insight into your credit management skills. Your Cibil score is generated as soon as you start building credit.

Your previous credit history and report plays a important role in determining this score. Due to the fact that it demonstrates your creditworthiness, lenders utilise it to access new loan applications.

Because the PAN information is linked to your financial accounts, it can be used to check your credit score. The score is checked alongside the PAN data because it is linked to your bank accounts.

You can check your CIBIL score for free on the official CIBIL website or through a number of third-party service providers using the information from your PAN card.

Here are a few websites that were known to offer free CIBIL score checks:

CreditMantri: CreditMantri (www.creditmantri.com) is a platform that provides free credit score checks and personalized credit-related advice. They may require you to sign up and provide your PAN card details to access your credit score.

Paisabazaar: Paisabazaar (www.paisabazaar.com) is a financial comparison website that offers a free credit score check service. They may require you to provide your PAN card details during the process.

BankBazaar: BankBazaar (www.bankbazaar.com) is another financial comparison platform that provides free credit score checks. They may require you to enter your PAN card details for verification purposes.

Please note that these websites may have specific terms and conditions, such as the frequency of free credit score checks or additional services they offer. It's always recommended to review the terms and ensure the security of your personal information before using any online service.

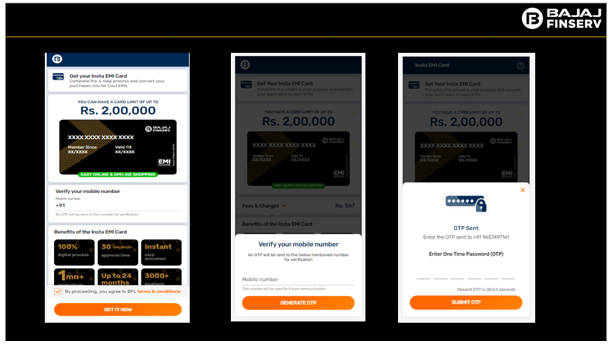

Here is a simple step-by-step guide to do a free CIBIL score check with your PAN card.

TO RUN A CREDIT SCORE CHECK ON THE CIBIL WEBSITE, FOLLOW THESE STEPS:

1. Type https://www.cibil.com/ in your browser.

2. Click on GET FREE CIBIL SCORE & REPORT.

3. Fill in the enrollment form with the necessary information.

4. Enter your email address, and create password. Then Enter First Name and Last Name.

5. Select "Income Tax ID Number" as the ID type, then enter your PAN data below.

6. Then input your Date of Birth, PIN code and mobile number.

7. Click on ACCEPT & CONTINUE.

8. You will receive an OTP on your mobile number. Enter the OTP and then press the CONTINUE button.

9. Now Choose GO TO DASHBOARD to view your credit rating.

10. You'll be redirected to the website myscore.cibil.com after that. After logging in, choose "Member Login" to view your CIBIL score.

Affiliate

Comments