Simple steps to e-file your Income Tax Return With Form-16.

- OfferZoneDeals Team

- Jul 7, 2022

- 3 min read

Updated: Jul 29, 2024

If you want to file your income tax return, you'll need to fill out an Income Tax Return (ITR) with a Form 16 for your particular financial year.

If you don't know how to do it or what steps to take, completing your ITR online with Form 16 can be a bit of a challenge. The process of filing your income tax return is not as difficult as it appears. Here's a step-by-step guide to e-file your ITR with form-16 using cleartax. It's straightforward, simple, and quick.

Here’s how to e-file Income Tax Return online with form 16 using cleartax.

Go to Google.com and type in "cleartax" in the search box or type https://www.cleartax.in in your browser.

1. Go to the Cleartax website and click Login on top right side of screen.

2. If you are already a member of the cleartax website then just login with your User Name/email and Password and click Login or you can Sign in with your Google account.

If you don't have a account then click "Not registered? Create an account."

3. If you have Google account then you can Sign up with your Google account. Just sign in with your Email/Phone and password.

Otherwise Just enter your email and create password. Click on checkbox below and Click on Agree and continue.

4. Click the "Start Filing" link to start the ITR filing process.

5. Enter your name as per PAN, Gender, date of birth, PAN number and father’s name and Click on Save.

6. Now enter your current or permanent address, Mobile number and email address.

Click Save.

7. Fill in the Salary information.

Enter Name of your Employer and Employer Type. Also provide your Salary and TDS details. Click Save

If you have changed jobs during the financial year, then Click on Save and Add another Salary.

Fill in Income from Other Sources If you have income from Interest, income from Saving Bank, Deposits, Dividend income from Mutual Fund, Income from Housing Property or Capital Gains etc.

8. You can also autofill data by just uploading your form 16.

Just click on "Click here to upload your Form-16 PDF.

9. If you have a PDF version of your Form 16, select 'Drop file here or Click to select'.

Click 'Continue without Form-16' if you don't have Form 16 in PDF format.

10. Fill in the Details for a Deduction Claim.

Check the investment information that was captured under the "Deductions" tab (such as Mutual Fund, PPF, LIC, etc.). You can change the fields and claim tax advantages here to include extra information that will save you money on taxes. Click on "Save".

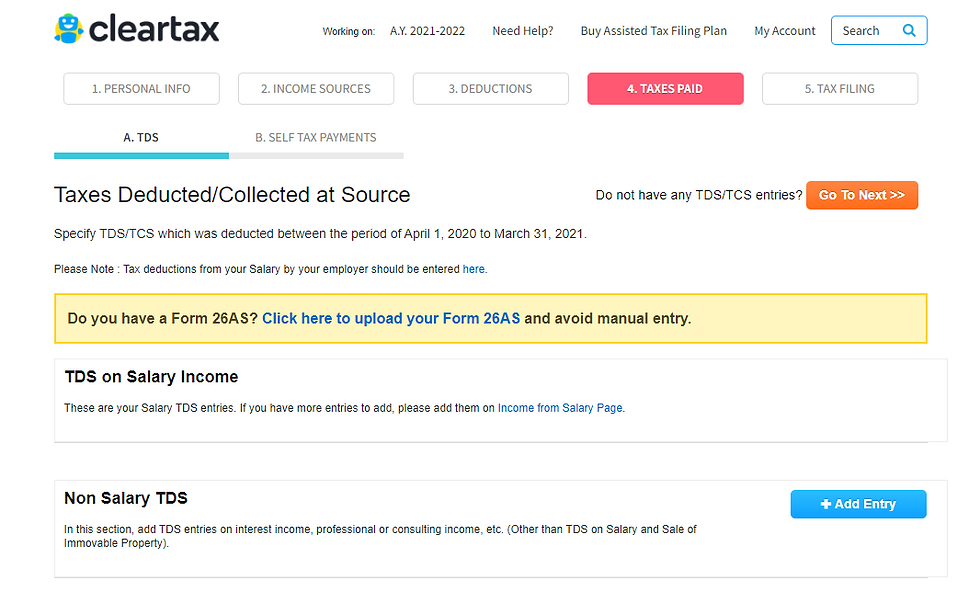

11. Enter the data regarding the TDS/TCS that was deducted in the financial year.

Include any tax payments you've already made if you get any non-salary income, such as interest or freelance income. You can include these details by uploading Form 26AS as well. When Form 26AS is uploaded, only the TDS details are automatically filled in; the revenue details must be placed where they should go.

Enter the details of the self-assessment tax that was paid for the relevant financial year under the tab labelled "Self Tax Payments."

Choose Go To Next.

12. Enter your Aadhaar details and bank account details and Click Save for proceeding towards e-filing.

13. Click on "Proceed to e-Filing" if you see 'Refund' or 'No Tax Due.' If you have a tax due, then pay your dues and then "Proceed to e-filing".

14. e-Verify your income tax return (through OTP received from Aadhaar linked Mobile number) once it's been filed. On the next screen, you'll see an acknowledgement number.

For your records, write down the acknowledgment number. Your tax return has been successfully filed. Keep the acknowledgment number in a safe place for future reference.

Comments